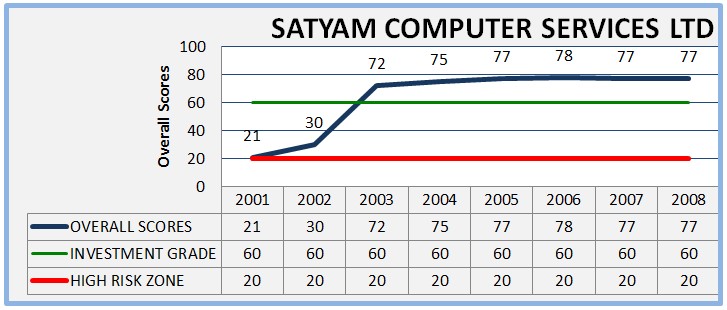

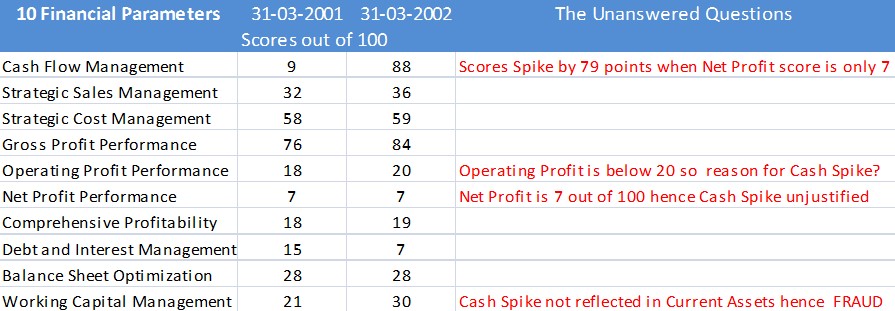

(iFinRanks unique Algorithmic Predictive Platform clearly proves that Satyam’s Cash Flow Management Scores touching 88 in 2002 is unjustified as its Net and Operating Profit are assigned POOR SCORES of only 20 and 7 respectively)

(One of the biggest Computer Software companies listed on both the BSE and the NSE with ADRs on the New York Stock Exchange – Satyam Computers was a darling of the bourses. However, iFinRanks flagged the company as poorly performing with a junk financial status in 2002. The Fraud of boosting Cash Flows with falsified Bank Balance Statements was clearly caught by iFinRanks, whose methodology judiciously uses Cash Flow Statements to evaluate the financial status of companies)

However the global Market kept buying shares in Satyam up until 2008 but iFinRanks subscribers withdrew their equity stakes and clearly WON – 6 YEARS AHEAD OF THE ACTUAL BANKRUTPCY!

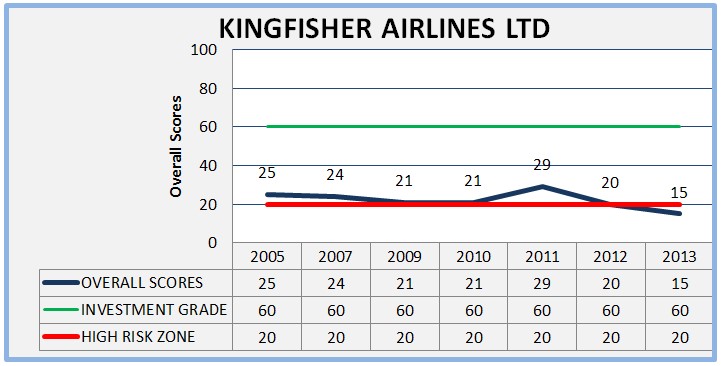

iFinRanks gives Advanced Notice of 6 years to its subscribers by downgrading Kingfisher Airlines to a low 25 out of 100 in year 2005. This score is only 5 points away from the High Risk Zone of 20. The actual grounding of the company to bankruptcy took place late in 2013 but iFinRanks’ subscribers including a leading Mutual Fund player pulled out in 2006 saving almost Rs 32 Crores just in time!

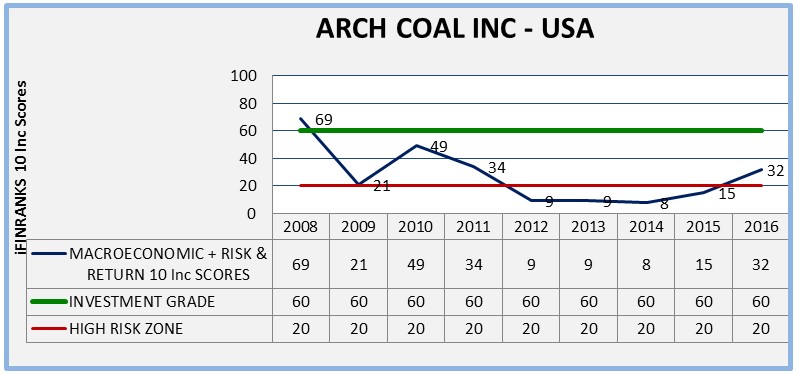

ARCH COAL INC. traded on the New York Stock Exchange elected to file for reorganization under Chapter 11 of the Bankruptcy Code on January 11, 2016, Arch Coal is a leading producer of metallurgical coal and the second largest producer of thermal coal in the United States. iFinRanks predicts the imminent bankruptcy way back in 2012 itself and thereafter it saw a free fall.

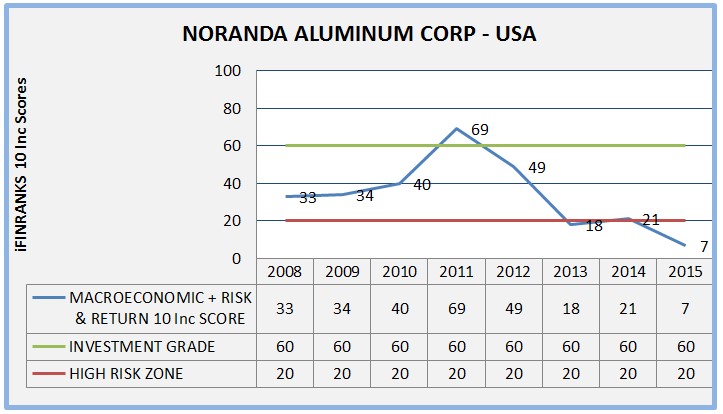

Noranda Aluminum Holding Corp, filed for voluntary bankruptcy protection in federal court on Feb. 8, 2016. It filed under Chapter 11 rules that would let it restructure its business operations. But, iFinRanks has flagged the company’s financial status to junk as early as 2013 with a 10 Inc Score of 18, which is within the High Risk Zone bandwidth

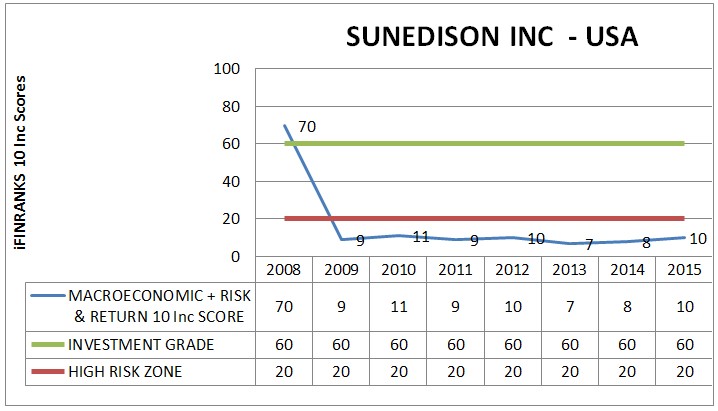

SunEdison Inc. once the fastest-growing U.S. renewable energy company, listed on NYSE filed for Chapter 11 bankruptcy protection on April 20, 2016 after a short-lived but aggressive binge of debt-fuelled acquisitions proved unsustainable. SunEdison stock is a classic Wall Street boom-and-bust story, with shares rocketing over 2,000% before eventually losing almost all of their value. iFinRanks downgrades the company to a low of 9 out of 100 in 2009 almost 6 years ahead of the bankruptcy.

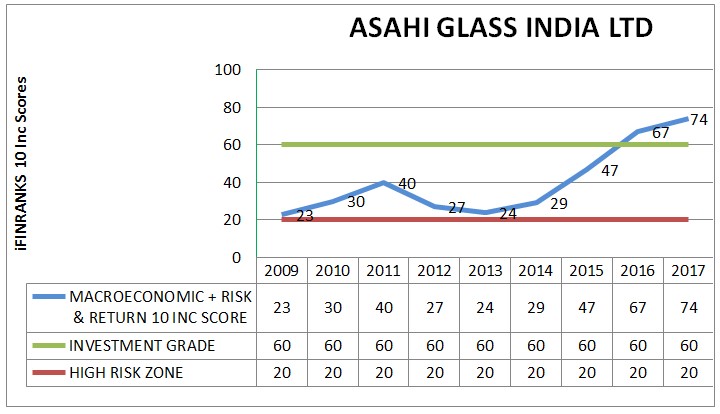

iFinRanks spots the Turnaround in Asahi India Glass in 2015 when it upgraded it by 20 scoring points to touch 67 and by March 2016 iFinRanks assigned it a 10 Inc Score of 73. An Advanced notice of 2 to 3 years enabling investors to “relook” at Asahi India Glass, which was languishing in the High Risk Zone. Many leading Mutual Funds and Institutional Investors took the cue and made a huge gain on iFinRanks’s predictions.

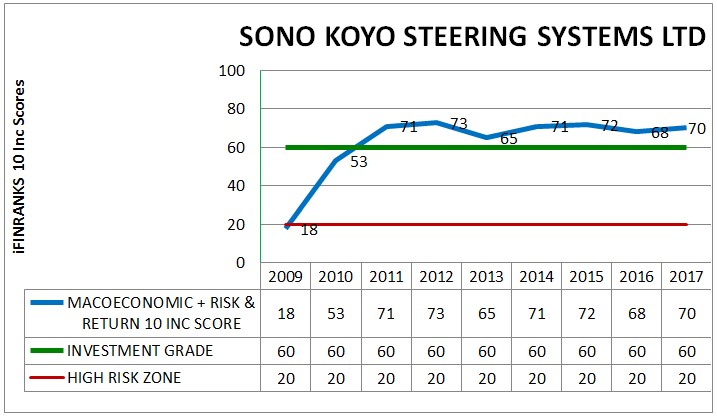

iFinRanks spots the turnaround in Sono Koyo Steering Systems in 2011 when it upgrades the company to a score of 75 out of 100 from a score of 57 in 2010 and a very low score of 15 in 2009. iFinRanks cutting edge Big Data Financial Analytics enabled our subscribers and market participants to gauge the value almost 6 years ahead of the rest of the investment fraternity.

iFinRanks spotting companies slipping into non-investment grades is remarkable

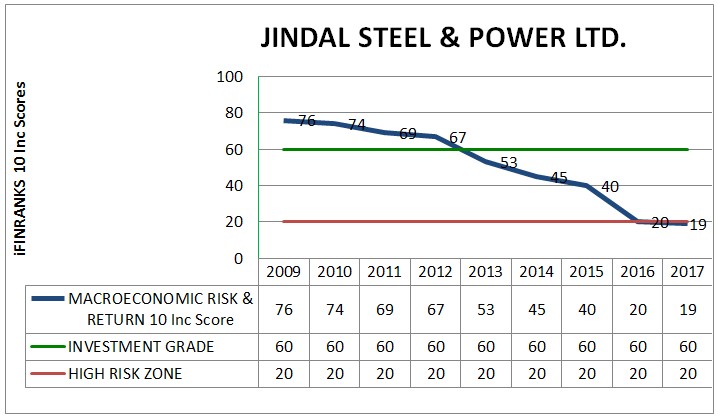

iFinRanks was the only agency which spotted the highs and the lows of Jindal Steel and Power Limited with uncanny accuracy. iFinRanks downgraded JSPL to below Investment Grade in June 2013 when its score fell from a high of 67 to a low of 53 with loan default probabilities. CRISIL the number one credit rating agency in India with a tie up with S&P waited until 2015 to do the same. iFinRanks subscribers and a prominent Mutual Fund said Thums Up to iFinRanks as they saved Rs. 120 Crores in a clean Exit Strategy.

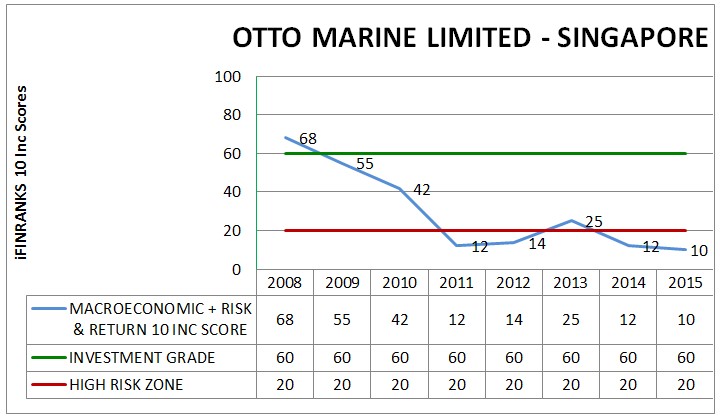

Otto Marine Limited, Singapore was delisted from SGX-ST in October 2016. iFinRanks had downgraded it to High Risk Zone with a poor score of 12 out of 100 in 2011, a good 5 years before the company was Delisted

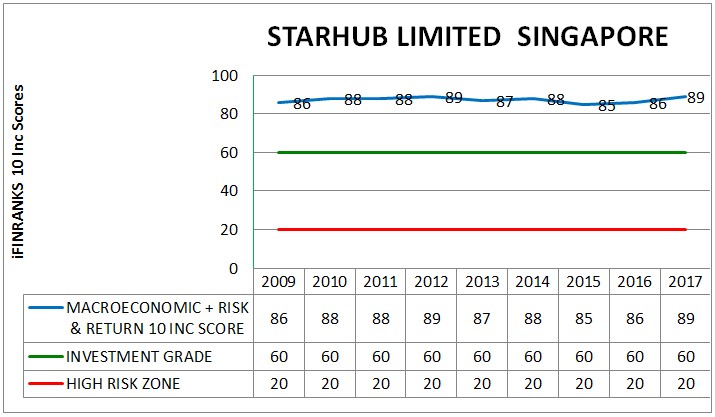

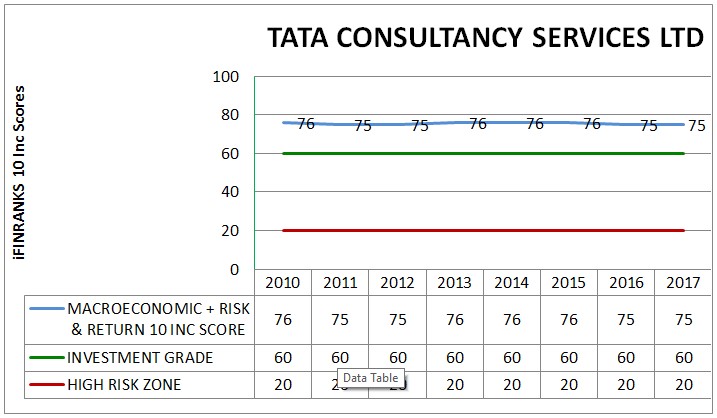

The Blue Line indicating the 10 Inc Scores have been almost 20 points higher than the Investment Grade line at 60 showing how iFinRanks correctly pins down the Winners and the Best Companies globally.

For Enquiry

Copyrights © 2020 ifinranks | Designed & Developed By Zauca